WildBearUnion.com: An unlicensed scammer who is not regulated by any authorities

WildBearUnion.com: An unlicensed scammer who is not regulated by any authorities

When you first visit WildBearUnion.com, you will be impressed by the interesting design (the bear on the main page!) and big numbers of fake “successful trades”. But we tried to go deeper than the first impression and figure out whether this broker could be trusted. Spoiler: no, it can’t. Behind the impressive numbers with no evidence and beautiful pictures, there is an ordinary scammer. Let’s figure out what led us to this conclusion.

- Broker name: WildBearUnion, wildbear union, wild bear union

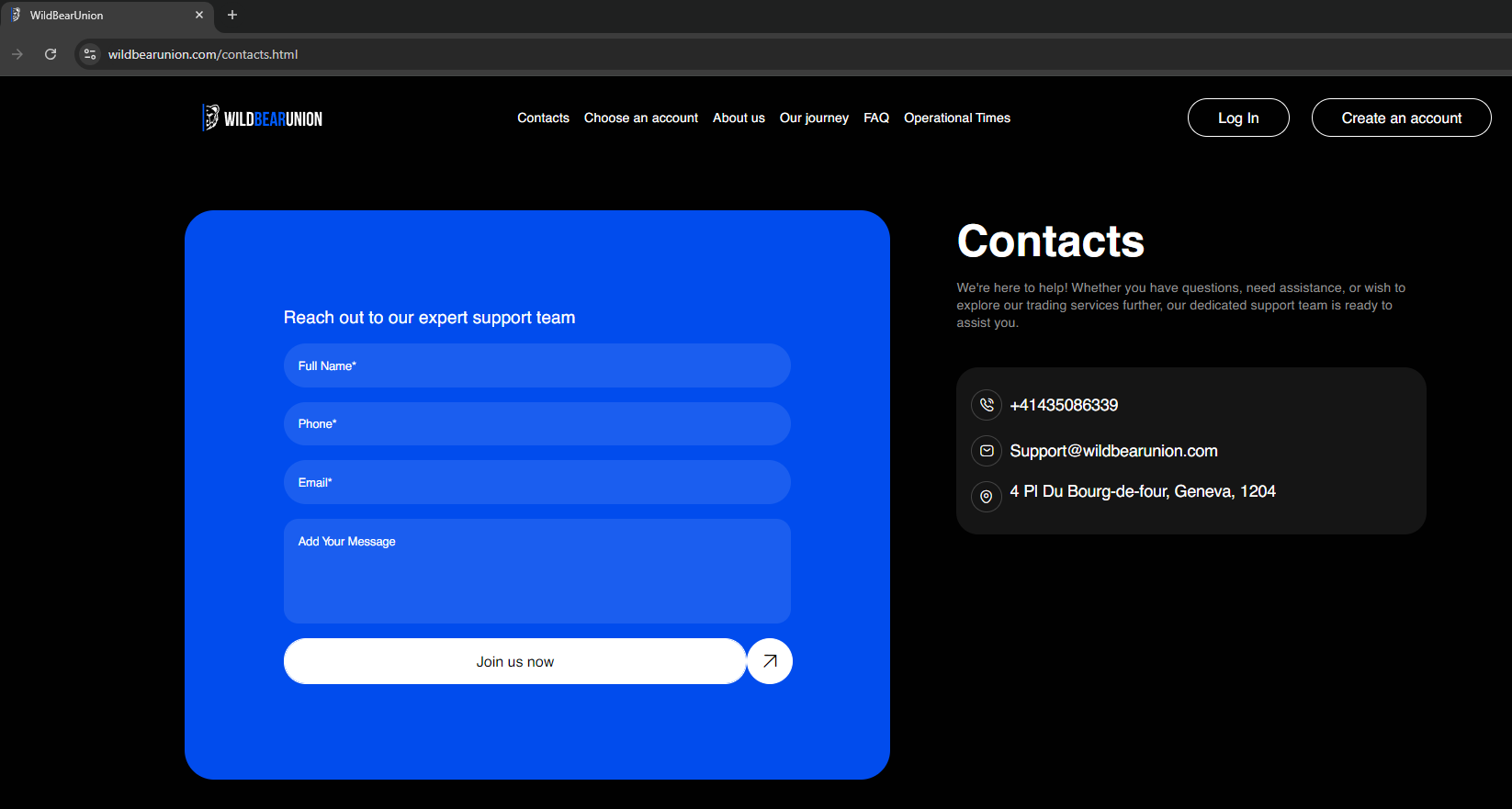

- Address: 4 Pl Du Bourg-de-four, Geneva, 1204

- Website: https://wildbearunion.com/

- Regulation: Not regulated by any legitimate company

- Customer support: Support@wildbearunion.com

- Language: English

- Phone number: +41435086339

First red flag: No license

The lack of a broker license is a serious red flag that should alert any investor. Licensed brokers are subject to strict requirements from government and financial regulators. These rules exist to protect the interests of investors and include fraud checks. WildBearUnion is not regulated by them.

Having a license is very important. If a licensed broker becomes insolvent or is found to be in violation of the law, clients can count on compensation through special funds or protection programs.

Due to the lack of a license, cooperation with WildBearUnion.com can lead to the complete loss of your investments. To avoid this, always check the availability of a license and its validity on the official websites of regulators.

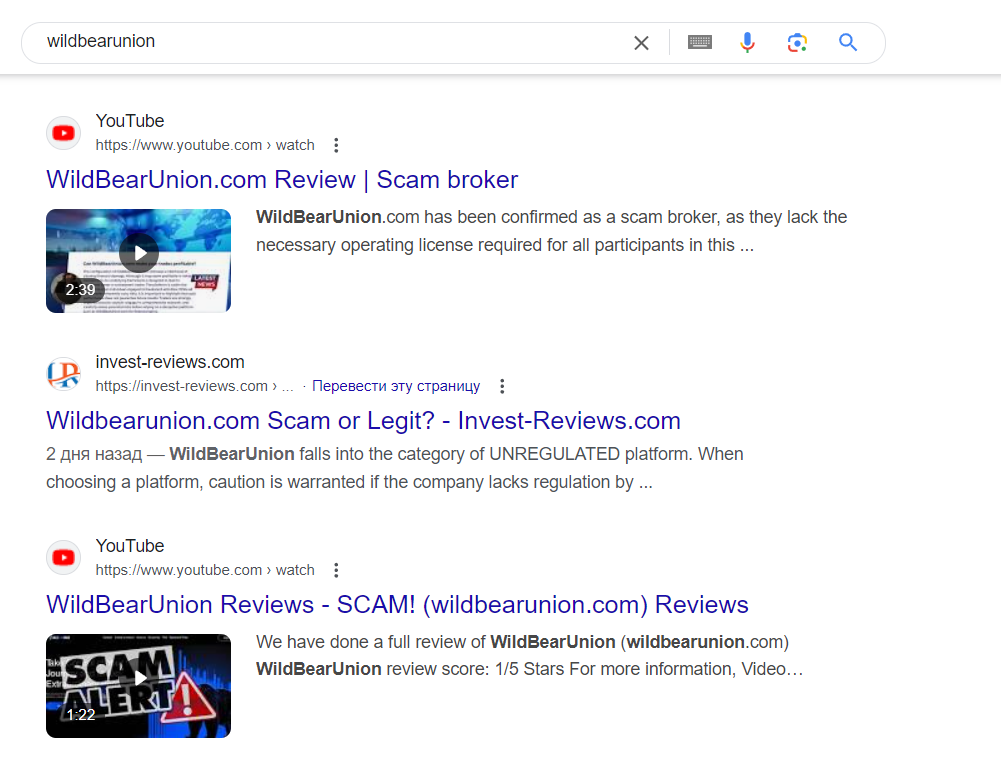

Second red flag: Negative customer reviews

The most telling indicator that you are dealing with fraud is the presence of negative reviews about it. And this broker has a lot of them. To convince yourself of this, it is enough to google its name. We will give just a few examples.

Fraudulent brokers often use different schemes to deceive clients, which leads to the loss of their investments. If a broker already has negative reviews, this is a signal of dishonest practices that clients have already encountered. For example, refusal or delay in withdrawing funds. Clients are faced with situation where it becomes difficult or impossible for them to return even their own investments. Many negative reviews indicate problems in the WildBearUnion work, which can affect every new client.

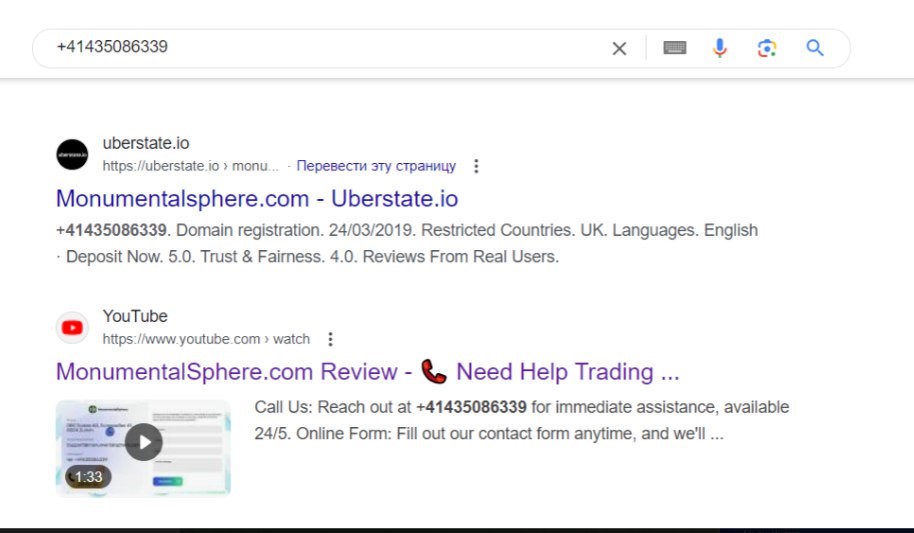

Third red flag: No information about the owners or the company

WildBearUnion doesn’t have any specific information about the owners, registration date, team, or any data that could be used to locate it in case of any problems. It provided a phone number, but if you google it, it turns out that it belongs to another company.

The "About us" page

The “About us” page contains only general phrases about philosophy and vision. Lots of interesting words about values and effectiveness, but no information that would really be about the broker. No details at all.

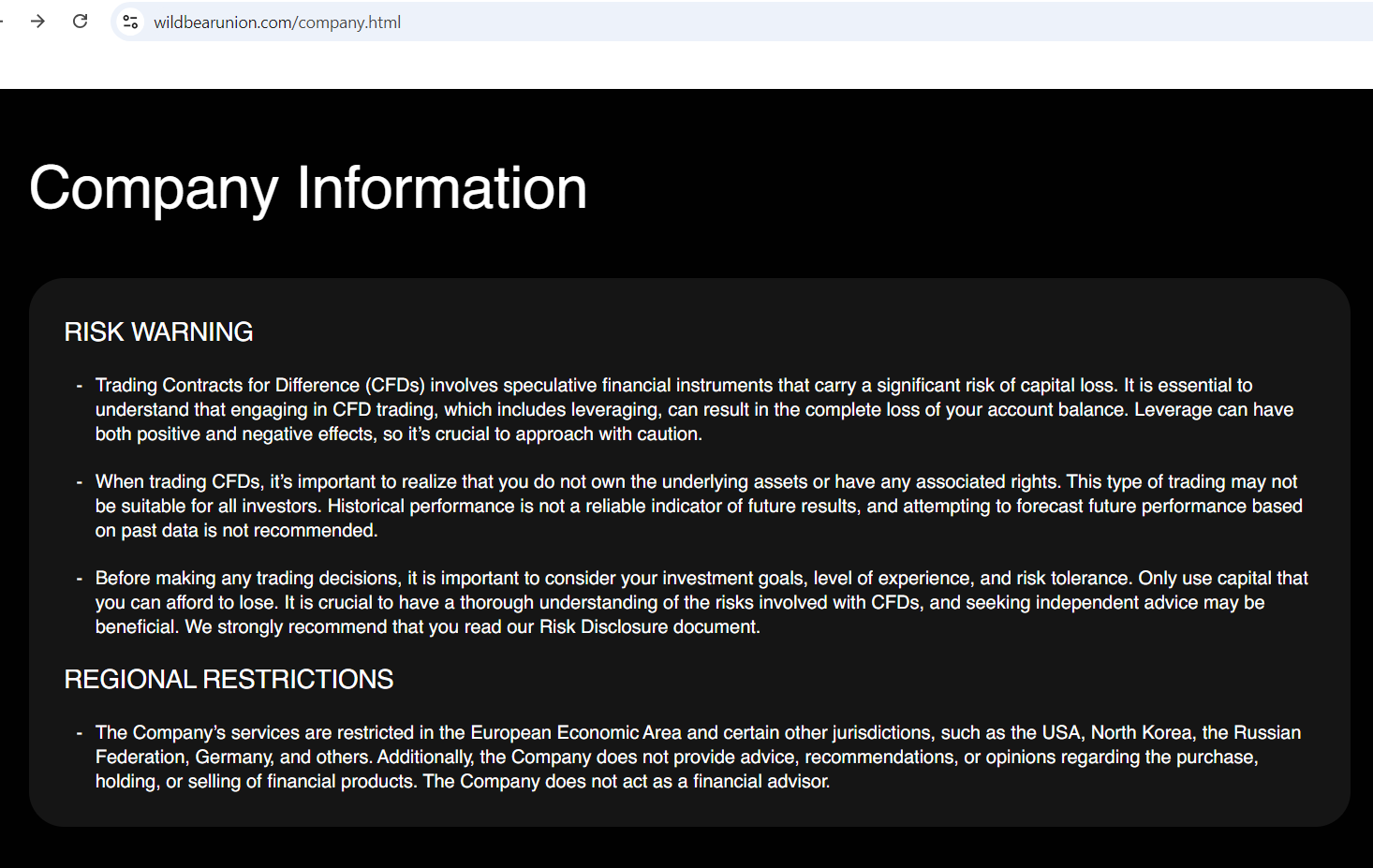

The "Company information" page

There is also a “company information” page, but there is not a word about the company itself. Only general information about the risks faced by the investor and regional restrictions.

Knowing the owners of the company allows the client to be sure that the brokerage firm belongs to reliable and proven individuals and not anonymous structures that may act in bad faith. The address and date of registration help determine whether the broker is located in a jurisdiction that is regulated by laws and has supervisory authorities.

All this guarantees the protection of clients’ rights in the event of disputes or problems. Therefore, unscrupulous brokers hide important information, which is a sign of fraud.

Fourth red flag: No press releases

There is always information about a legal company in the press. It is happy to share its news and innovations. If WildBearUnion does not publish news about its activities, it means that it is trying to hide some important aspects of its business.

In addition, public companies often receive independent reviews and analyses from the media and experts. There is no information about the WildBearUnion.com so it means that its activities have not been sufficiently checked, or that it is avoiding the attention of regulators and the public.

Reputable brokers receive positive coverage in the press due to their success, quality service, and licenses. Because there are no publications or reviews about WildBearUnion this indicates that the company is deliberately hiding its activities from the public.

Fifth red flag: Not regulated by any credible authority

The WildBearUnion activities are not regulated by any control systems. This is dangerous for several reasons:

-

Regulated brokers are required to comply with strict laws and regulations aimed at protecting investors’ rights (requirements for disclosure of information, ensuring transparency of transactions, etc.).

-

Regulators require brokers to keep client funds separate from the company’s own funds in order to avoid situations where the broker can use the client’s funds for its own needs, reducing the risk of losing money.

-

Under the control of regulators, brokers are required to execute client transactions according to fair and transparent rules, which minimizes the risk of fraud or market manipulation.

-

Regulated brokers are regularly checked for financial stability and liquidity.

-

If a client has problems or disputes with a broker, the presence of regulation gives the opportunity to contact the regulator to resolve them.

WildBearUnion does not comply with any of these rules, because the owners of the company don’t want their activities to be controlled. This is a clear indication of their fraudulent intentions.

Final conclusion on the WildBearUnion.com scam

Based on all the red flags listed, we can be absolutely sure that this broker is a scammer. Cooperation with it can lead not only to a lack of profit, but also to the loss of initial investments. Be careful when choosing a broker and checking all the nuances.

If you have already encountered the activities of WildBearUnion, we will be grateful for your feedback on it. Please leave your opinion in the comments.

I bought into the pretty picture and invested here. Now I can’t get my money back. Scammers!!!

The platform is slow and the tech support is completely unresponsive. I suspect that they may actually be scammers.

As soon as I invested the first amount, they immediately stopped responding to me. I was never able to get the money back, so it’s good that the amount was not very large.